Buying or selling a business is a significant decision that demands clarity, precision, and transparency. Our transaction advisory and financial due diligence services deliver tailored, data-driven insights that empower you to navigate complex transactions with confidence.

Our services are designed to uncover the financial realities that drive informed, strategic decision-making. Our expertise in accounting, tax, and financial due diligence allows us to provide clear, actionable insights at every stage of your business lifecycle.

Business Owners

Capital Providers

Executives

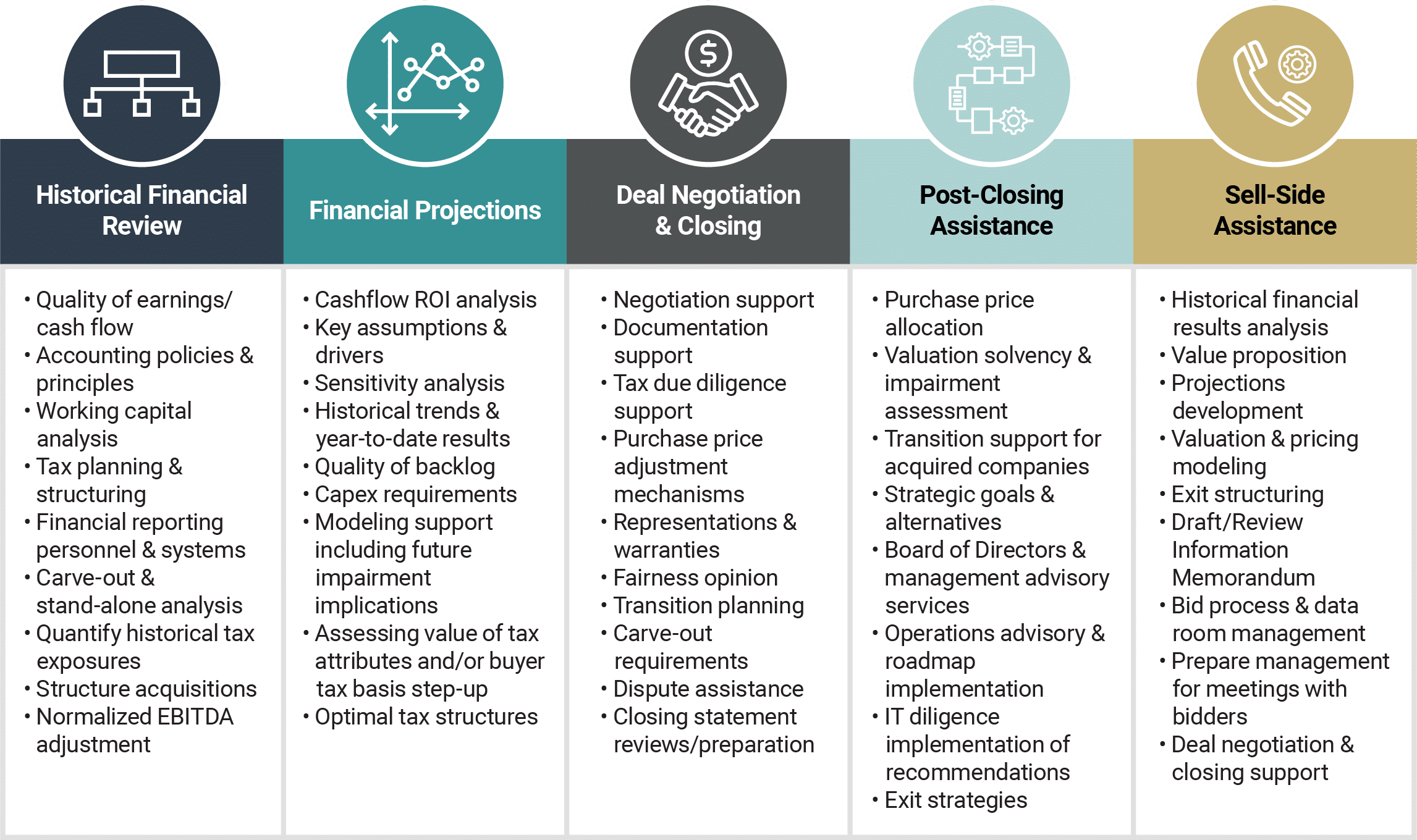

Comprehensive Transaction Advisory Services

Our team provides end-to-end support—from initial financial reviews through closing and post-transaction integration. With deep expertise across accounting, tax, and financial due diligence, we deliver actionable insights at every stage of the transaction process. We help you:

- Identify financial and operational risks

- Validate key financial metrics

- Optimize tax efficiency

- Evaluate sustainable earnings

- Maximize transaction value

Our multi-disciplinary approach ensures that you gain a clear understanding of the risks, opportunities, and value drivers unique to your transaction.

Our multi-disciplinary approach ensures that you’ll be abreast of the risks and opportunities involved in a transaction. We’ll also help you understand the pros and cons of each choice made during the entire transaction lifecycle, and our innovative solutions will ensure you’re making the right decision for your individual circumstances.

Transaction advisory services include:

Financial Due Diligence & Analysis

Historical Financial Review

Analyze past performance to assess trends, profitability, and risks.

Quality of Earnings (QoE) Reporting

Identify adjustments and anomalies to present a true picture of sustainable earnings.

Working capital analysis

Evaluate liquidity and operating efficiency to support transaction readiness.

Normalized EBITDA adjustments

Isolate core operating results to assist in valuation and investment decisions.

Forecasting & Tax Structuring

Financial Projections & ROI Analysis

Assess future performance, validate assumptions, and evaluate the alignment of projections with historical trends.

Optimal tax structure review

Identify tax exposures and structure transactions for maximum efficiency and compliance.

Deal Structuring & Negotiation Support

Purchase agreement review

Ensure alignment with strategic goals, identify risks, and recommend revisions.

Purchase Price Adjustments & Deal Analysis

Support negotiations with robust financial insights to optimize value and reduce exposure.

Closing Statement Preparation & Review

Validate the accuracy of closing documentation and ensure regulatory and financial compliance.

Post-Close Advisory & Integration

Valuation & Fairness Opinions

Deliver objective insights on deal value, solvency, and fairness.

Post-Transaction Integration & Strategic Advisory

Assist with operational integration, implementation of strategic initiatives, and support for divestitures or reorganizations.

Exit Planning

Guide business owners through exit strategies that maximize stakeholder value, whether through sale, merger, or succession.

Tailored Insights for Capital Providers, Business Owners, and Executives

We understand that every stakeholder has unique priorities. That’s why our services are designed to be flexible, thorough, and customized to your specific goals. From early-stage due diligence to post-close execution, we are committed to delivering clarity, minimizing risk, and creating value.

Let’s Talk

Whether you’re evaluating a potential investment, planning an acquisition, or preparing for a sale, our experts are here to support your decision-making with accuracy and integrity. Contact us to learn how we can help you move forward with confidence.