As your company grows, so does the complexity of your tax challenges. Are you sure you’re complying with the maze of tax requirements that apply to multi-state businesses — and that you’re not overpaying simply because you don’t have the right information? Turn to Mauldin & Jenkins for specialized tax advice and services, delivered with the collaborative approach and comprehensive understanding you need to simplify your tax picture and ensure consistent compliance with federal, state and local tax authorities.

COULD THESE COMMON TAX TRAPS APPLY TO YOUR BUSINESS?

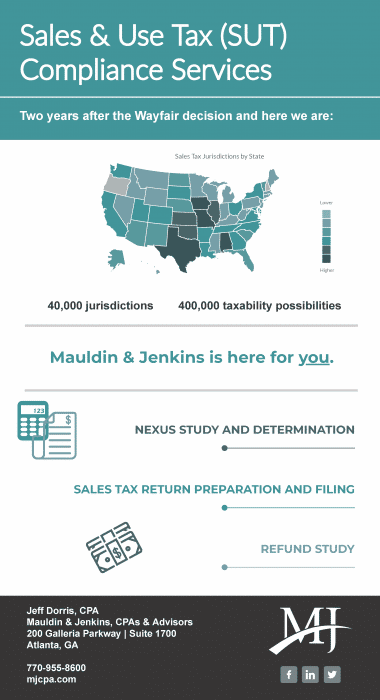

If you sell products or services in multiple tax jurisdictions, your tax compliance requirements are not only complicated, but always changing. Failure to meet sales and use tax reporting deadlines and fulfill evolving compliance obligations puts your company at risk for substantial penalties that could derail progress toward your business objectives.

Besides the risk of noncompliance and an increased likelihood of audits, there’s a real possibility that your business is paying too much tax. It’s a common problem for businesses with multiple locations, which often pay more property tax than necessary. In addition, companies with physical locations in multiple states frequently overlook tax credits and incentives that could lower your tax bill. Even routine accounting issues can lead to excess taxation that negatively impacts your bottom line.

SAVE WITH SPECIALTY STATE AND LOCAL TAX SERVICES

Our specialty tax advisors offer guidance and services to help you avoid tax pitfalls that could limit profitability and expose your company to excess risk. Whether it’s expert solutions for complex property tax questions, ongoing support to ease the burden of sales and use tax compliance in multiple states or training your internal team on best practices for consistent compliance, we’ve got you covered.

Services we provide for Specialty taxes include:

Property Tax

PROPERTY TAX COMPLIANCE & RETURNS

Efficiently manage property taxes, including filing appeals and representing your interests before local tax boards.

ASSESSMENT EVALUATION

Verify the accuracy of annual assessments and discover potential savings opportunities.

ASSET REVIEW

Review your business property for federal, state and local property tax valuations and establish fair market value based on current market data.

REASSESSMENTS

Pursue reassessments, exemptions and savings opportunities with state, county and local tax authorities to minimize your property tax liability.

Sales and Use Tax (SUT)

SUT Software Onboarding

Select and implement the latest software and receive ongoing guidance and support on data migration, system configuring, and user training.

Nexus studies

Gain clarity around income, franchise and sales and use tax obligations in each jurisdiction through an analysis of your operations, sales and

purchases.

PRODUCT TAXABILITY REVIEW

Avoid overpaying on taxes with a review of products sold or purchased to determine taxability by jurisdiction, and potential

exemptions.

VOLUNTARY DISCLOSURE AGREEMENT

Get expert assistance as you participate in state Voluntary Disclosure Agreement programs to manage unpaid or underpaid tax liabilities.

ONGOING SUT EVALUATION

Keep up with SUT compliance responsibilities and tax savings opportunities without diverting your focus from core business functions.

EXEMPTION CERTIFICATE MANAGEMENT

Ease the pressure on internal resources

by letting us monitor deadlines, updates and other exemption certificate responsibilities.

JURISDICTIONAL REGISTRATION

Streamline jurisdictional registration in every location where you have nexus.

INTERNAL COMPLIANCE AUDIT

See a clear view of what you’re buying and selling as well as the process with an in-depth audit of accounts receivable, accounts payable and fixed assets.

REVERSE AUDIT

Discover potential overpayment of sales tax that may have taken place in an audit that a state auditor conducted.

REFUND STUDY

Identify sales tax overpayments with a review of accounts payable,

so your specialty tax team can then file refund requests and relevant sales tax returns.

AUDIT REPRESENTATION

Let us manage your audit from start to finish, relieving you of the stress and time burden of interacting with auditors.

MOCK AUDIT

Prepare for official evaluations with mock audits to help you anticipate potential issues and achieve the outcome you want.

Credits

Energy Tax Credits

Maximize tax credits for investments in renewable energy, energy efficiency, and sustainable practices under the Inflation Reduction Act (IRA). Our team identifies qualifying projects, assists with documentation, and ensures compliance to maximize your energy-related tax benefits.

Research and Development (R&D) Tax Credits

Ensure compliance with IRS Section 41 and optimize your R&D tax credit benefits with our expert guidance. Accurately document qualifying research activity expenditures, including those related to software development, product design, and process improvement, for IRS form 6765.

Georgia Job Tax Credits

Claim every credit you're due with Georgia's Job Tax Credit, which incentivizes businesses to create and retain jobs. Whether you're in manufacturing, pharmaceuticals, medical supply, or another qualified industry, we'll navigate the requirements and maximize your tax benefits.

Georgia Retraining Tax Credits

Get expert guidance on how to offset the costs of upskilling your workforce. We will help you identify opportunities to invest in employee training on new equipment, technologies, or job skills at minimal cost.

Georgia Manufacturing Tax Credits

We help Georgia manufacturers secure the state's Manufacturing Tax Credit, which can be used for expenses related to research, manufacturing facilities, personal protective equipment, and job creation. Our team will help you determine your qualifications and then analyze your investments in these areas to optimize your tax savings under this program.

Other Tax Credits

Take advantage of the range of tax incentives offered. We can help you explore these additional opportunities, determine which credits best align with your business goals, and learn how to qualify.

TAME TAX RISKS WITH OUR SPECIALTY TAX SERVICES

It’s not realistic to expect in-house staff to know the latest laws in every state or formulate a sophisticated multi-state tax strategy. Connect with our specialty tax team for informed insights and deep expertise that help you navigate your toughest compliance challenges, manage risk effectively and uncover tax savings opportunities that benefit your business.

WHAT OUR CLIENTS ARE SAYING

"The services provided by Mauldin & Jenkins have been excellent. Specifically, Jeff Dorris helped us successfully navigate through a significant sales tax project. He took the time to fully understand our needs and provided straight-forward guidance. Jeff is very knowledgeable, thorough and truly a pleasure to work with, and I recommend him without reservation."

"Jeff Dorris and the entire M&J team have been extremely helpful in getting Sunnyland Farms compliant with new sales tax requirements following the Wayfair decision. They have taken the time to not only understand the complexities of our business but also help us code all of our products correctly for all state and local tax jurisdictions. Trying to do these tasks without their assistance and guidance would have been virtually impossible. I would highly recommend engaging Jeff and his team to assist with any sales tax issues."

Specialty Tax Practice Leader

REQUEST A CONSULTATION

How can we help you achieve your goals? Please enter your details below, and one of our team members will contact you soon.