New standards and increased reporting responsibilities have placed stringent requirements and demands on governments. These regulations have created the need for governments to employ professional firms specializing in providing a vast array of services for the governmental sector. With a dedicated team focused on providing auditing, accounting, financial reporting, and consulting services to governmental entities throughout the Southeast, Mauldin & Jenkins is a recognized and proven leader.

OUR EXPERIENCE & GENERAL APPROACH

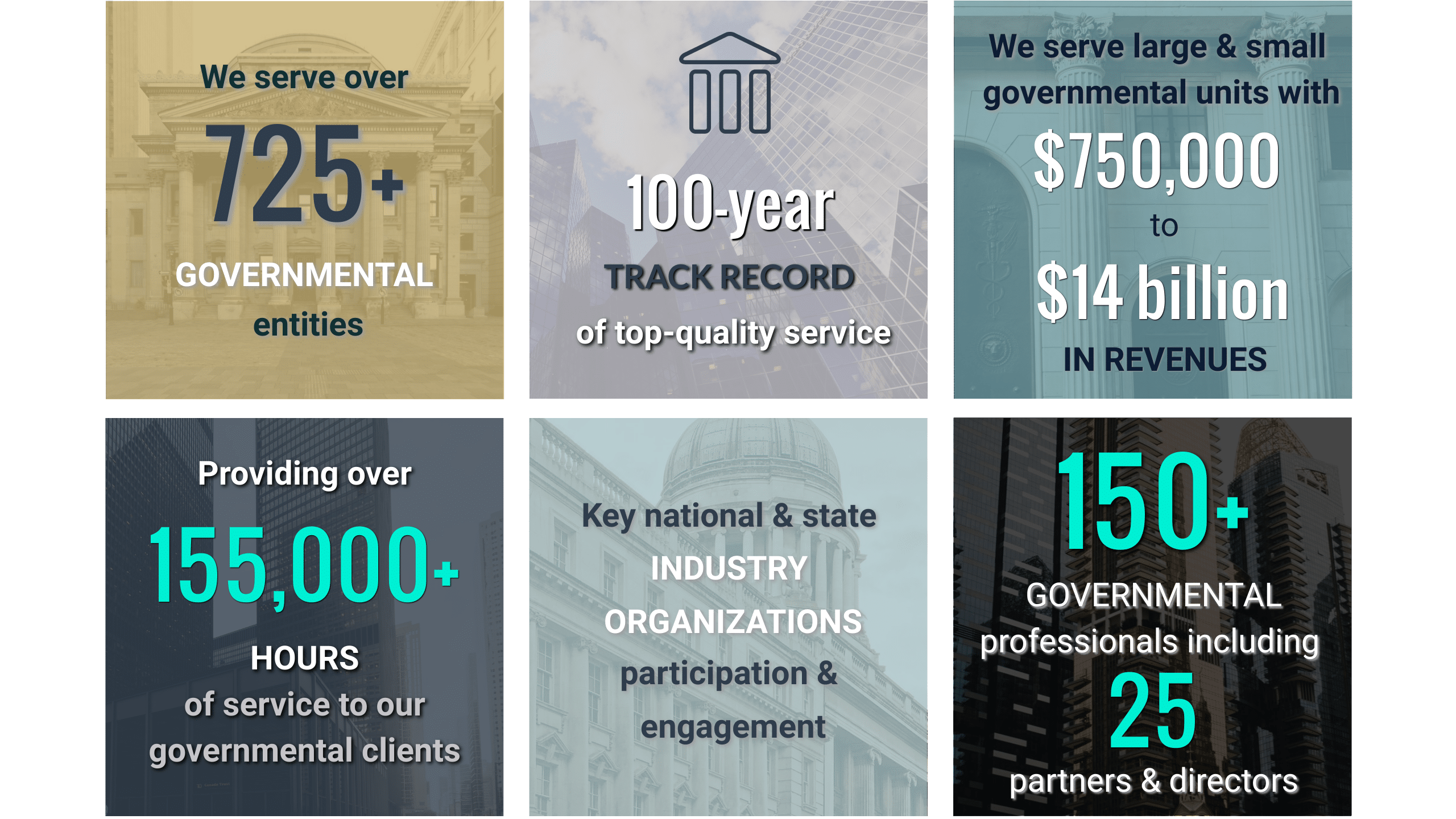

Mauldin & Jenkins currently serves over 725 state and local governmental units across the southeastern U.S.A. This includes large and small governmental units currently ranging from revenues of $750,000 to $5.8 billion. We have previously audited a large state entity with revenues of approximately $14 billion.

Our governmental sector is served by a large group of partners, directors, managers, and other professional staff. Utilizing the skills and talents of over 140 professionals in the governmental sector, we proactively respond to the needs and requests of our clients and meet their deadlines.

In the past 25 years, we have performed over 600 transitions as the new auditors of various governmental entities. Each member of our client services team offers a great deal of experience serving new clients and providing smooth transitions during a change in auditors. A key element of our services surrounds our ability to be responsive via open and ongoing dialogue and good working relationships. We take our experiences and tailor our approach to fit our governmental clients’ needs and expectations.

We pride ourselves on responding to the needs of our clients and meeting their deadlines. This responsiveness is not only the ability to meet specified audit deadlines, but also the ability to respond to other requests. Our ability to be responsive is enhanced by the open communications and good working relationships we have with our clients. Our resources provide for the flexibility to meet your needs and to perform our services in an efficient and effective manner.

Our partners, managers, and seniors in the Firm’s Governmental Practice Division spend 100% of their time serving governments. By structuring the Firm’s Governmental Practice Division in such a manner, we are able to create efficiencies in the audit process, which typically result in our total hours being significantly less than most other firms which results in substantially less burden and hassle to our clients.

ENTITIES WE SERVE

Mauldin & Jenkins serves a variety of state and local governmental entities throughout the Southeast.

Cities

Counties

School Districts

Charter Schools

State Government Agencies, Authorities, Commissions & Depts.

Federal Agencies

Special Purpose Entities

Water & Sewer Operations

Gas & Electric Utilities

Mass Transit Operations

Airport / Aviation Operations

Municipal Solid Waste Landfills

Stormwater Operations

Library Systems

Community Services Boards

Boards of Health

Disability & Special Needs Entities

Tax Allocation Districts

Special Service Districts

Industrial Authorities

Development Authorities

Planning Commissions

Governmental Defined Benefit and

Contribution Plans

Governmental OPEB Plans

Empowerment Zones

Housing Authorities

Public Facility Authorities

Building Authorities

Land Bank Authorities

Mosquito Districts

Recreation Authorities

Convention & Visitors Bureaus

Component Units

Joint Ventures

ASSURANCE SERVICES

We serve a wide array of governmental units by performing various assurance services.

Financial Audits

Single Audits

Forensic Audits

Performance Audits

Compliance Audits

IT Assessments & Examinations

Agreed-upon Procedures

Attestation of Management Assertions

Landfill Assurance Services

Bond Issuance Consent & Comfort Letters

One thing to note is the fact that Mauldin & Jenkins currently performs over 225 Federal Single Audits annually, and ranks as one of the largest provider of such attestation services in the country. Learn more about our assurance services.

ADVISORY SERVICES

Our experienced government advisory team helps governments, governmental agencies, and quasi-governmental organizations balance fiscal responsibility with the latest business strategies to achieve targeted and overarching objectives. Learn more about our advisory services.

Innovation

Long-Term Planning

Organizational Management

Strategy Mapping

Technology Consulting / ERP

Operation Vision

Business Case

Change Management & Organizational Transformation Strategies

Customer Service Optimization

Service Model Delivery

Human Capital Management

Cost Containment

Operations Improvement

Program Delivery

Revenue Enhancement

Budget Forecasting & Design

Cost Accounting

Data Science

Grant Strategy

Internal Controls & Compliance

KPI Design / Benchmarking

Project Management

Management / Dashboard Reporting

INFORMATION TECHNOLOGY SERVICES

We have resources to address the evolving cybersecurity threats to your government - having Certified Information Systems Auditors (CISA) on staff and are certified by the AICPA to provide cybersecurity advisory services and the newly created cybersecurity assessment. Specifically, information technology services we currently provide to governments include:

SOC for Cybersecurity

Physical and/or Electronic Social Engineering

Cybersecurity Framework Assessments

IT System Vulnerability Assessments

IT Penetration Testing

Annual Cybersecurity Training

OTHER SERVICES

We provide many other services to the governmental sector not included under the umbrella of assurance or advisory. Such services are deemed to be value-added elements which can only be provided by a large team of professionals specializing in serving governmental units. These services include:

- Annual Comprehensive Financial Report Preparation

- Financial Statement Preparation

- Accounting, Financial Reporting, and Year-end Close-outs

- Education and Training at all Levels

Budgetary Analysis - Capital Asset Accounting and Reporting

Cash Flow Management

The IRS is actively assessing penalties on large employers covered by the Affordable Care Act (ACA). The penalties assessed for failing to file or failing to furnish correct ACA information returns are significant. We can assist with penalties assessed under the ACA, as well as penalties from payroll and employee information return filings. Tax controversies can arise at any time, even for state and local governmental entities, often without warning. Our team of experienced professionals ensures that your entity can navigate any tax controversy with sound guidance and resolution in a prompt manner. Learn more about our Tax Controversy & Resolution services.

On an annual basis, Mauldin & Jenkins serves over 150 governmental clients who prepare and receive the Government Finance Officers Association (GFOA) Certificate of Achievement for Excellence in Financial Reporting, and, or the Association of School Business Officials (ASBO) Certificate of Excellence in Financial Reporting.

QUARTERLY FREE EDUCATIONAL SERVICES

For over a decade, Mauldin & Jenkins has provided free continuing education to our governmental clients. These educational settings are provided on a quarterly basis, both virtually and in person, affording our clients the opportunity to register and receive approximately 30 hours of continuing education on an annual basis at no cost. We take our experience in serving governments and choose timely and relevant topics to provide ongoing education to our clients.

ACTIVE IN THE GOVERNMENTAL INDUSTRY

Mauldin & Jenkins is a dedicated service provider to the governmental sector. On an annual basis, we attend, participate, and speak at approximately 30 governmental conferences.

We have individuals who are active leaders in the industry and who represent the firm by serving on committees and boards of the American Institute of Certified Public Accountants (AICPA), including the Government Audit Quality Center, the State and Local Government Expert Panel, as well as various special task forces. We've also had a representative on the Government Accounting Standards Advisory Council (GASAC). We have people who voluntarily participate with the Government Finance Officers Association (GFOA) Certificate of Excellence in Financial Reporting Program, and the Government Accounting Standards Board. In fact, in 2020, one of our Governmental Partners was appointed to serve as the Chairperson of the GASB. Our dedication to serving the governmental sector is nationally recognized.

Going Further

Mauldin & Jenkins understands the regulations placed upon governmental entities. As a leader in the governmental accounting industry, Mauldin & Jenkins' services and expertise will provide your governmental entity a knowledgeable audit, as well as the best accounting, financial reporting, and consulting services.

Resources

Government Insights

If you would like to view more of our Government Insights, please use the button below.