Often, leaders are so focused on generating new business, serving customers, and paying the bills that they don’t pause to examine the big picture. Besides money coming in and going out, what are these ebbs and flows revealing about my business? It’s easy to overlook cash flow analysis in favor of more immediate demands, but there’s risk associated with omitting this crucial step. If you don’t have clear visibility into cash flow and the implications behind it, your business could run into problems or missed opportunities – even when business is booming and everything seems to be going fine.

The role of finance in supporting key cash flow insights for your business

By Chris Fields

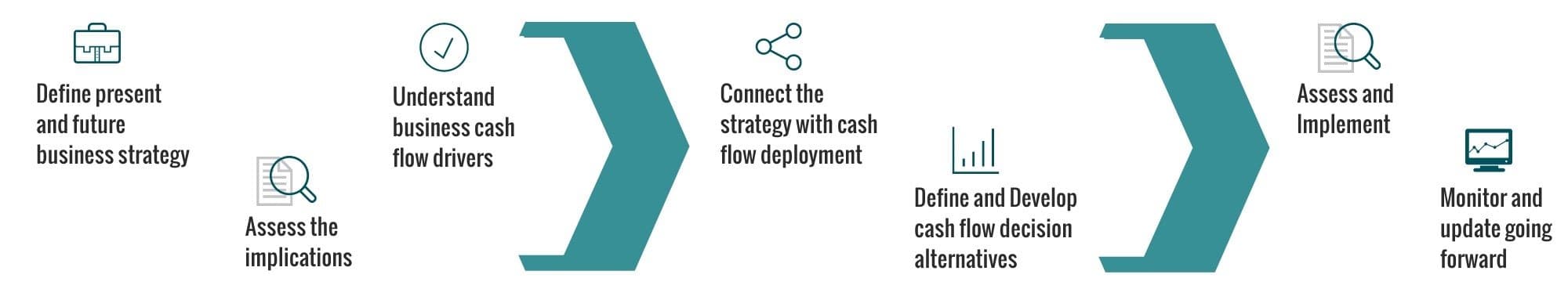

Do you know the recurring and non-recurring cash flow components of your business? Do you regularly prepare cash flow projections and assess their implications? How can you optimize access to needed capital and what investments can you afford to make (or not to make!)? What are the various implications of key resource deployment decisions you are facing right now (best, worst, most likely cases)? Do you find your business doing “alright”, but wondering where it goes next and a financial roadmap for how to get there? Is your current level of growth outstripping your ability to absorb additional capacity in the near future? Without an accurate understanding of historical metrics when developing a forward-looking picture of your business’s plans, the answers to these questions are really just a guess. Understanding cash flow metrics, reporting, and forecasting provide supportive insights you as a business owner need to make informed decisions and guide your company through shifting economic tides.

Often, leaders are so focused on generating new business, serving customers and paying the bills that they don’t pause to examine the big picture. Besides money coming in and going out, what are these ebbs and flows revealing about my business? It’s easy to overlook cash flow analysis in favor of more immediate demands, but there’s risk associated with omitting this crucial step. If you don’t have clear visibility into cash flow and the implications behind it, your business could run into problems or missed opportunities – even when business is booming and everything seems to be going fine.

A cashflow analysis comprehensively “marries” the profit and loss statement with the balance sheet, and helps provide meaningful insights which help identify opportunities or close gaps. The impact of receivable and payable turns can also be analyzed to determine how variances impact cashflow. Margin erosion or Operating leverage can be tracked to determine their respective contribution (or cost) to business cash flow, and how the business either “deploys” operating cash flow, or “accesses” external cash flow from lines of credit, investment returns, etc. are evaluated.

The benefits are significant. Clarity around the real drivers of a company’s cashflow resources and needs and determining appropriate levels of liquidity allows for optimal decisions about making investments in the business, taking on new debt, or determining whether that attractive opportunity is truly a good idea right now.

Establishing tools and mechanisms to monitor your cash flow also helps you identify issues that could impact the business’s long-term strategy or even threaten long-term viability, while there’s still time to correct course. A few months of consistently negative cash flow might be a red flag that requires serious attention. A pattern of positive cash flow, on the other hand, can indicate you’re on track to meet or exceed annual growth targets. This positive indicator may also imply that your capacity to meet future demand could be a challenge before you anticipated. This implication could even lead you to need to revise your long-term business strategy to address growth.

Does your business have a subtle seasonal ebb and flow? Many businesses do and monitoring cashflow over time reveals this pattern. If the numbers don’t appear seasonal and you’re in the black year-round, you might want to investigate strategies to make better use of the extra cash you’re generating, once you’ve stashed away an adequate cushion for slower times and emergencies. Assessing the level of “adequate” liquidity cushion is also an important strategy to define, develop, implement, and monitor.

A successful business isn’t just about serving customers well. It’s about serving your business well, too, so it can continue to grow and thrive for years to come. Careful attention to short- and long-term cash flow and the underlying implications lets you understand how much your business needs over time, create projections and forecasts so you know what to expect, and make the best decisions possible as you work toward your long-term goals.

To learn more about how cash flow analysis and forecasting can benefit your business, contact Chris Fields of our Client Accounting and Advisory services team at Mauldin & Jenkins.

cash flow analysis and forecasting

Contact us to find out how we can help you.